Blockchain Explained in Depth: What It Really Is, How It Works, and Why It Matters

Blockchain is one of the most talked-about technologies of the 21st century, yet it remains widely misunderstood. To some, it is synonymous with cryptocurrency speculation. To others, it is a revolutionary system capable of transforming finance, governance, identity, supply chains, art, and even the way humans coordinate trust at a global scale.

This article aims to strip away hype and confusion and explain what blockchain actually is, how it works at a technical and conceptual level, why it was created, and what problems it solves. We will move step by step—from first principles to advanced mechanisms—so that by the end, you will not only understand blockchain, but also be able to reason about its strengths, limitations, and real-world impact.

1. The Core Problem Blockchain Was Designed to Solve

To understand blockchain, you must first understand the problem of trust in digital systems.

1.1 Trust in Traditional Systems

In most modern systems, trust is handled by central authorities:

Banks verify balances and transactions

Governments maintain land registries

Corporations store identity and user data

Platforms control digital ownership

If you send money via a bank, you trust the bank to:

Keep accurate records

Not alter history

Not block or reverse transactions arbitrarily

This model has worked reasonably well—but it has structural weaknesses:

Single points of failure

Corruption or manipulation

Censorship

High costs and inefficiencies

Limited access for billions of people

1.2 The Digital Double-Spending Problem

In the digital world, information is easy to copy.

If I send you a photo, I still have it.

If I send you a file, I can send the same file again.

But money cannot work like that. If digital money can be copied, it becomes worthless.

Historically, the solution was simple: a central ledger maintained by a trusted institution.

Blockchain proposes something radical:

What if we could maintain a shared, tamper-resistant ledger without trusting any single authority?

2. What Blockchain Actually Is (In Plain Terms)

At its core, a blockchain is:

A distributed, append-only database that is shared across many independent computers and secured by cryptography and economic incentives.

Let’s break that down.

2.1 A Ledger

A blockchain is fundamentally a ledger—a record of transactions or state changes.

Examples:

Transfers of digital currency

Ownership of assets

Execution of agreements (smart contracts)

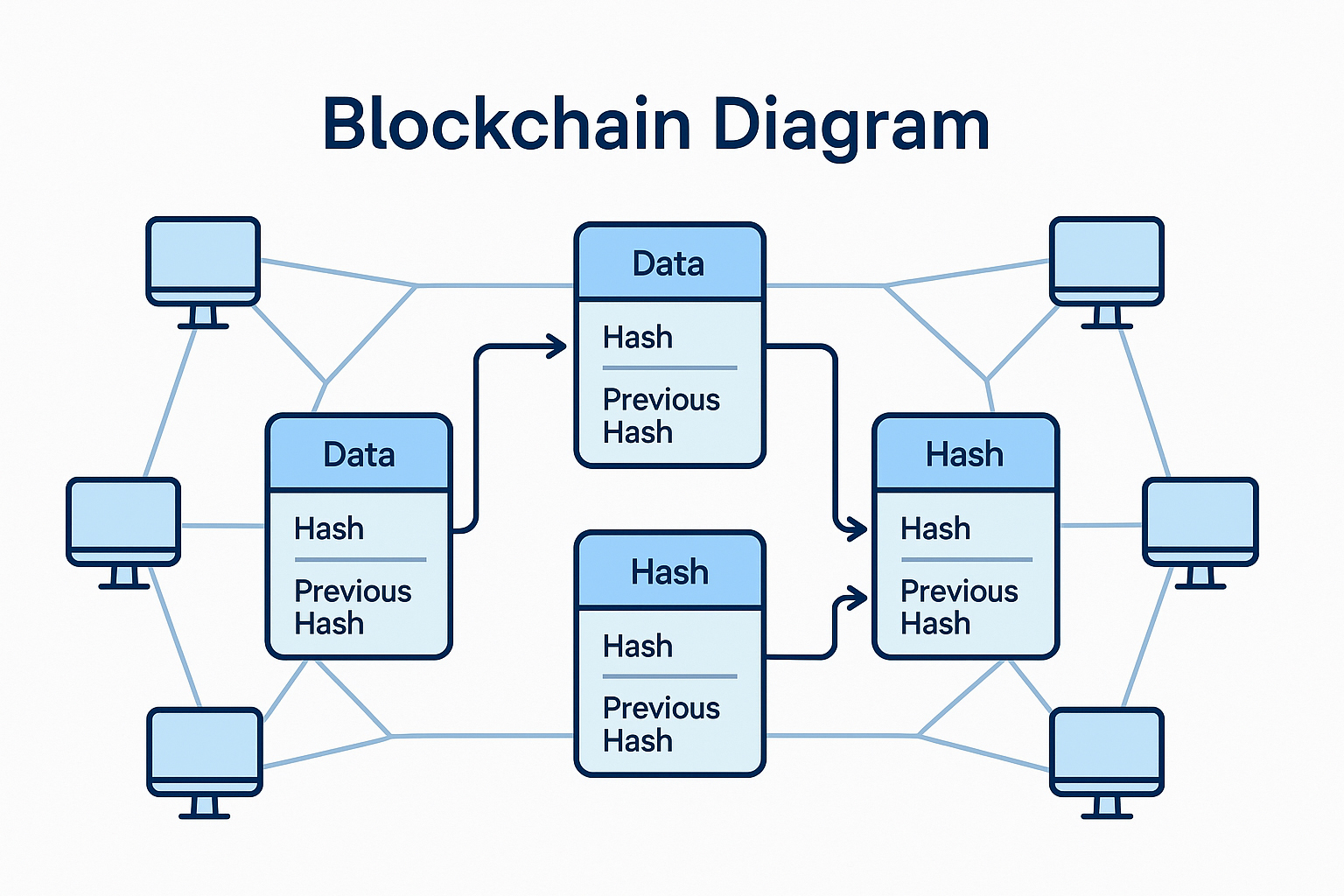

2.2 Distributed

Instead of being stored on one server, the ledger is replicated across many nodes (computers) in a network.

Each node:

Holds a full or partial copy of the blockchain

Independently verifies new data

Communicates with peers

There is no central database to attack or control.

2.3 Append-Only

Data on a blockchain is not edited or deleted.

Instead:

New data is added in blocks

Each block references the previous one

History becomes computationally impractical to change

This creates immutability—not absolute, but economically enforced.

2.4 Cryptographically Secured

Blockchain uses cryptography to ensure:

Authenticity (who signed what)

Integrity (data hasn’t been altered)

Order (which transaction came first)

This is achieved through:

3. Blocks, Chains, and Hashes

3.1 What Is a Block?

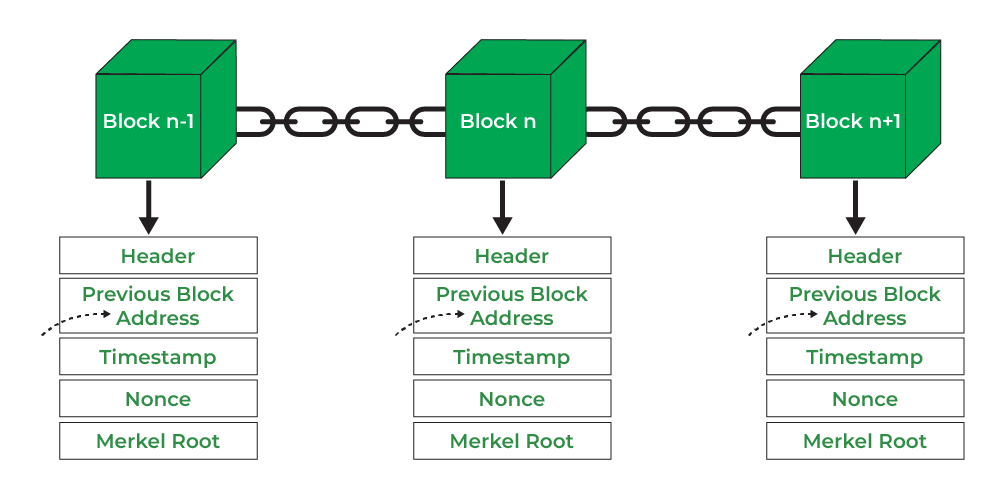

A block is a container of data. Typically, it contains:

A list of transactions

A timestamp

A reference (hash) to the previous block

A cryptographic proof (depending on consensus)

3.2 Hashes: The Glue That Holds It Together

A hash is a fixed-length output generated from input data.

Key properties:

Deterministic

Extremely sensitive to change

One-way (cannot be reversed)

If even a single character in a block changes, its hash changes completely.

3.3 The Chain

Each block includes the hash of the previous block.

This means:

Blocks are mathematically linked

Altering one block would require recalculating all following blocks

On large networks, this becomes infeasible

This is why it’s called a blockchain.

4. Decentralization: More Than Just Many Computers

Decentralization is not binary. It exists on a spectrum.

4.1 Types of Decentralization

Architectural – many physical nodes

Political – many independent owners

Logical – no single point of control

A system can be distributed but still centralized in control.

Blockchain aims for all three forms.

4.2 Why Decentralization Matters

Decentralization provides:

Censorship resistance

Fault tolerance

Reduced reliance on trust

Global accessibility

No single entity can:

Shut the system down

Rewrite history unilaterally

Freeze assets arbitrarily

5. Consensus: How Blockchains Agree on Reality

If many independent nodes maintain a ledger, how do they agree on what is true?

This is solved by consensus mechanisms.

5.1 The Byzantine Generals Problem

In distributed systems, some participants may:

Fail

Lie

Act maliciously

Blockchain consensus mechanisms are designed to tolerate these failures and still reach agreement.

5.2 Proof of Work (PoW)

The first widely successful consensus mechanism.

Key idea:

Nodes (miners) compete to solve cryptographic puzzles

Solving the puzzle gives the right to add a new block

The puzzle is costly to solve but easy to verify

Security comes from economic cost.

Changing history would require enormous computational power.

This mechanism underpins Bitcoin.

5.3 Proof of Stake (PoS)

An alternative that replaces computation with economic stake.

Validators:

Lock up (stake) tokens

Propose and validate blocks

Lose stake if they act dishonestly

Security comes from financial risk rather than energy expenditure.

This model is used by Ethereum after its transition to PoS.

5.4 Other Consensus Models

Delegated Proof of Stake (DPoS)

Practical Byzantine Fault Tolerance (PBFT)

Proof of Authority

Hybrid systems

Each represents different trade-offs between decentralization, speed, and security.

6. Cryptography: The Mathematical Backbone

Blockchain is not magic—it is applied cryptography.

6.1 Public-Key Cryptography

Each user controls:

A private key (secret)

A public key (shared)

Transactions are signed with the private key and verified with the public key.

This enables:

Self-custody

Permissionless participation

Non-repudiation

6.2 Digital Signatures

Digital signatures ensure:

Authenticity (who sent it)

Integrity (unchanged data)

No central authority is required to verify identity.

6.3 Merkle Trees

Merkle trees allow:

Efficient verification of large datasets

Proof that a transaction exists in a block

Lightweight clients (SPV)

They dramatically reduce computational overhead.

7. Transactions: From Creation to Finality

Let’s follow a transaction step by step.

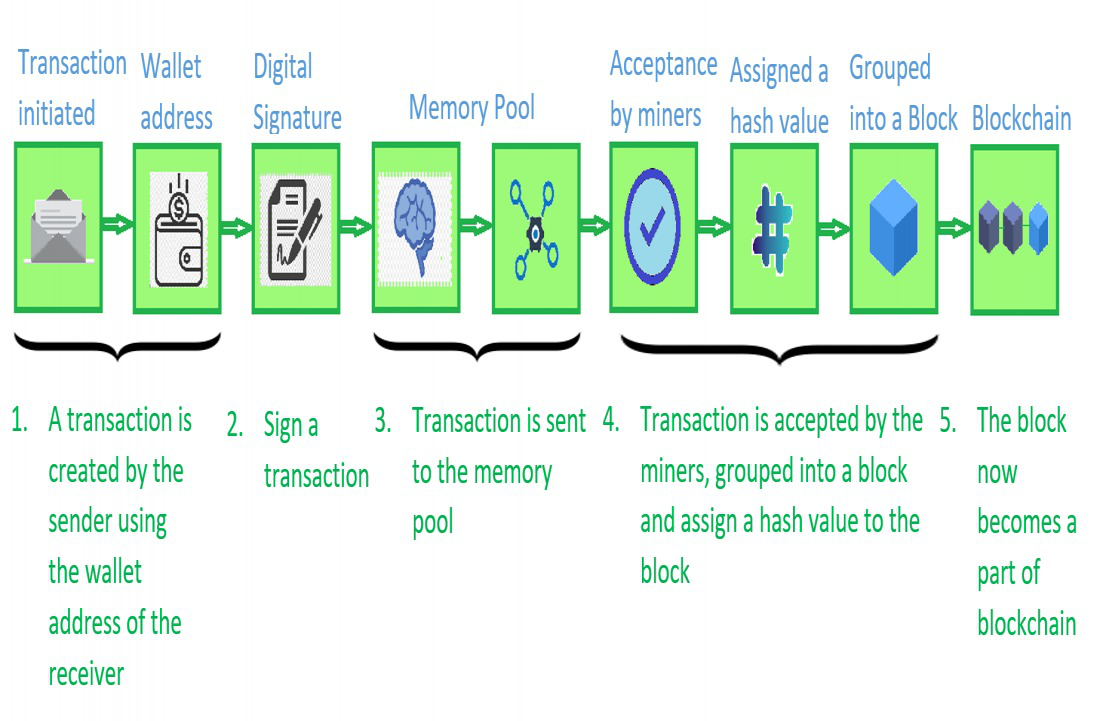

7.1 Transaction Creation

A user:

Constructs a transaction

Signs it with their private key

7.2 Broadcasting

The transaction is broadcast to the network and enters a mempool (waiting area).

7.3 Validation

Nodes verify:

Signature validity

Sufficient balance or state

Compliance with protocol rules

7.4 Block Inclusion

A validator or miner includes the transaction in a block.

7.5 Confirmation and Finality

Once included:

Additional blocks increase confidence

Some systems provide probabilistic finality

Others offer deterministic finality

8. Smart Contracts: Code as Law

One of blockchain’s most transformative features is smart contracts.

8.1 What Is a Smart Contract?

A smart contract is:

A self-executing program stored on the blockchain that runs when predefined conditions are met.

It is:

Deterministic

Transparent

Tamper-resistant

8.2 What Smart Contracts Enable

Decentralized exchanges

Lending and borrowing protocols

NFTs and digital ownership

DAOs (Decentralized Autonomous Organizations)

Automated insurance and escrow

8.3 Limitations

Smart contracts are:

Only as good as their code

Difficult to upgrade

Vulnerable to bugs

They enforce rules, not intent.

9. Tokenization and Digital Assets

Blockchain enables the creation of native digital assets.

9.1 Fungible Tokens

Identical and interchangeable:

Cryptocurrencies

Stablecoins

Utility tokens

9.2 Non-Fungible Tokens (NFTs)

Unique and non-interchangeable:

Digital art

Collectibles

Identity credentials

Intellectual property

9.3 Token Standards

Standardization allows:

Interoperability

Tooling

Ecosystem growth

10. Blockchain Trilemma

Blockchain systems face a fundamental trade-off:

Decentralization

Security

Scalability

Improving one often weakens another.

10.1 Scaling Solutions

Layer 2 networks

Sidechains

Rollups

Sharding

Each attempts to balance the trilemma differently.

11. Public vs Private Blockchains

11.1 Public (Permissionless)

Anyone can participate

Highly decentralized

Censorship resistant

11.2 Private (Permissioned)

Controlled participation

Faster and cheaper

Less trustless

Used mainly in enterprise contexts.

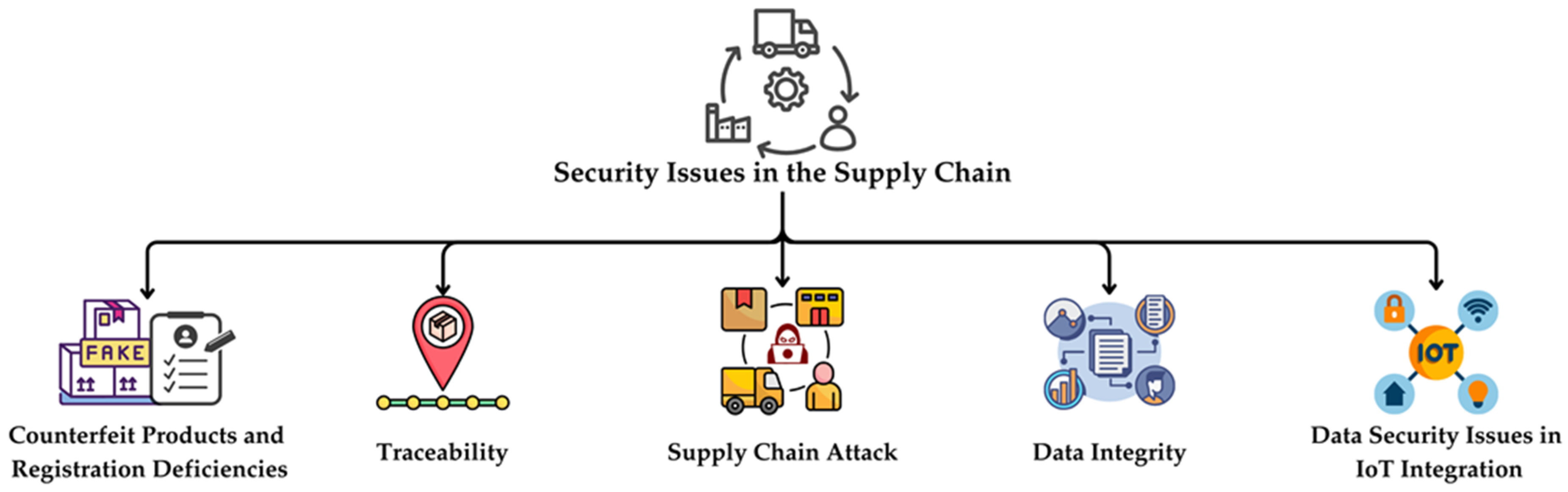

12. Real-World Use Cases Beyond Cryptocurrency

Supply chain tracking

Digital identity

Voting systems

Healthcare records

Cross-border payments

Decentralized finance (DeFi)

Not all use cases require blockchain—but some are uniquely enabled by it.

13. Limitations and Criticisms

Blockchain is not a silver bullet.

13.1 Technical Challenges

Scalability

Energy consumption (PoW)

Complexity

13.2 Social and Regulatory Issues

User error and self-custody risk

Legal uncertainty

Governance disputes

Understanding blockchain requires separating potential from reality.

14. Why Blockchain Matters (Even If You Never Use Crypto)

Blockchain introduces a new paradigm:

Trust minimized, verification maximized.

It allows:

Ownership without intermediaries

Coordination without central control

Systems that outlive their creators

Even if specific projects fail, the ideas behind blockchain—cryptographic trust, decentralized consensus, programmable value—are likely to shape future systems.

15. The Bigger Picture

Blockchain is not just a technology. It is:

A new economic layer

A coordination protocol

A philosophical challenge to centralized power

Like the internet in its early days, its most important applications may not yet exist.

Understanding blockchain today is not about predicting prices—it is about understanding how digital trust can be re-engineered.

Final Thought

Blockchain replaces institutional trust with verifiable truth, enforced by math, incentives, and open participation. Whether it becomes infrastructure as fundamental as the internet or remains a specialized tool will depend not only on technology—but on how humans choose to use it.

If you understand blockchain at this level, you are already ahead of most of the world.

Comments

Post a Comment